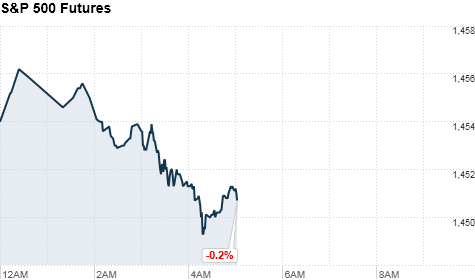

Click on chart for more premarket data.

NEW YORK (CNNMoney) -- U.S. stocks were set to slide at the open Tuesday, following world markets lower, as investors face continued uncertainty over Europe's debt crisis.

World markets slid into the red as investors keep a wary eye on any developments out of Europe.

European stocks were all about 1% lower in Tuesday morning trading. Asian markets ended in the red with the Shanghai Composite dropping 0.9%, the Hang Seng in Hong Kong was off 0.3% and Japan's Nikkei fell 0.4%.

On the domestic front, investors head into Tuesday awaiting quarterly earnings from FedEx (FDX, Fortune 500), which are due before the bell. The global shipping company is expected to post quarterly earnings of $1.40 a share on $10.7 billion in revenue, according to a survey of analysts by Thomson Reuters.

FedEx is often considered a bellwether for the global economy due to its size and worldwide presence as well as the nature of its business. The shipping giant cut its earnings forecast earlier this month, citing weakness in the global economy.

There will also be a report on builder confidence that follows the Federal Reserve's announcement last week that it would buy $40 billion of mortgage-backed securities each month.

U.S. stocks finished lower Monday as investors took a step back from last week's Fed-inspired rally.

Fear & Greed Index

Economy: The National Association of Home Builders will release the September edition of its builder confidence index at 10 a.m. ET. The index is expected to come in at 38, up from 37 last month, according to a survey of analysts by Briefing.com.

At 8:30 a.m. ET, the Commerce Department will release second-quarter data on the nation's current account balance. At 9 a.m. ET, the Treasury Department will publish data on foreign purchase of Treasuries for July.

Companies: British soccer club Manchester United (MANU) will also report its financial results Tuesday morning, after going public on the New York Stock Exchange last month.

Apple (AAPL, Fortune 500) shares hit another all-time high Monday, coming within spitting distance of $700 in regular trading following strong early sales data for the iPhone 5. Shares topped $700 after hours.

Shares of Office Depot (ODP, Fortune 500) got a boost Monday after activist investment firm Starboard Value disclosed a 13% stake, making it the company's biggest shareholder. Starboard made a case for improving the "undervalued" business in a letter to Office Depot's CEO.

Shares of AMD (AMD, Fortune 500) were off more than 7% in premarket trading after the chip maker revealed Monday that its chief financial officer was stepping down.

Currencies and commodities: The dollar strengthened against the euro and the British pound, but weakened against the Japanese yen.

Oil for October delivery fell 51 cents to $96.11 a barrel.

Gold futures for December delivery dropped $11.10 to $1,759.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.80% from 1.84% late Monday. ![]()

First Published: September 18, 2012: 5:37 AM ET

18 Sep, 2012

-

Source: http://rss.cnn.com/~r/rss/money_news_international/~3/0hRAu5BR99A/index.html

--

Manage subscription | Powered by rssforward.com

Anda sedang membaca artikel tentang

Stocks: Investors pull back

Dengan url

http://ourhearthealthy.blogspot.com/2012/09/stocks-investors-pull-back.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks: Investors pull back

namun jangan lupa untuk meletakkan link

sebagai sumbernya

0 komentar:

Posting Komentar