NEW YORK (CNNMoney) -- U.S. stocks edged lower Thursday, as disappointing reports in Asia and Europe showed further signs of a persistent global slowdown.

Dow Jones industrial average, S&P 500 and Nasdaq were all in the red as markets opened.

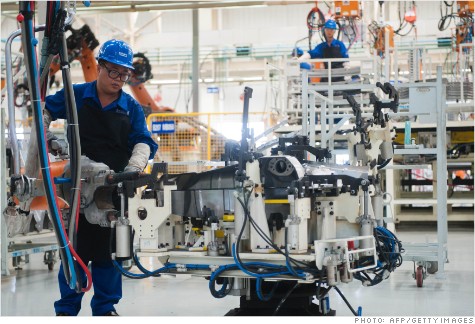

Investors were reacting to an HSBC report on Chinese manufacturing, which showed that manufacturing in the world's second-largest economy continued to contract in September. That pushed Asian markets down between 1% and 2%.

European markets were also hit with news pointing to a lagging economy, with Markit's regional purchasing managers index falling to a 39-month low. That marks the fastest contraction of new business and services in more than three years. European stocks all dropped in afternoon trading.

Related: Fear & Greed Index

On the domestic front, first-time unemployment benefit claims in the U.S. fell for the week ended Sept. 15, down 3,000 from the previous week to 382,000. Although the Labor Department figure is down 3,000 from the previous week, it's still not low enough to ease worries about continued high unemployment.

Investors will also be looking to the Federal Reserve Bank of Philadelphia's regional business outlook survey released at 10 a.m. to see if there is further sign of a slowdown following disappointing manufacturing data from the New York Fed out earlier this week.

U.S. stocks ended little-changed Wednesday, as investors wait to see if stimulus measures from central banks across the globe will jumpstart the global economy.

Related: Factory data sends China stocks to nearly 4-year low

Companies: ConAgra Foods (CAG, Fortune 500) shares shot up more than 5% after the food processing company beat expectations by reporting earnings of 44 cents per share.

Shares of the nation's largest car retailer, CarMax (KMX, Fortune 500), were lower after the company reported earnings that fell below estimates.

Rite Aid (RAD, Fortune 500) shares were also higher after the drugstore chain's reported loss of 5 cents per share came in smaller than anticipated.

Shares of investment bank Jefferies (JEF) were down more than 7% despite reporting higher-than-expected earnings before Thursday's open.

Shares of railroad operator Norfolk Southern (NSC, Fortune 500) were down after the company lowered its third-quarter guidance Wednesday. Fellow rail transport firms CSX (CSX, Fortune 500), Union Pacific (UNP, Fortune 500)and Kansas City Southern (KSU) also fell on the news.

Shares of Bed Bath & Beyond (BBBY, Fortune 500) were lower after the retailer missed earnings estimates.

Online real estate site Trulia announced late Wednesday that it had priced its initial public offering at $17 a share. The company will begin trading on the New York Stock Exchange Thursday under the symbol "TRLA."

Currencies and commodities: The dollar rose against the euro and British pound, but it fell versus the Japanese yen.

Oil for October delivery fell 33 cents to $91.65 a barrel.

Gold futures for December delivery fell $5.30 to $1,766.40 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.74% from 1.78% late Wednesday.

First Published: September 20, 2012: 9:44 AM ET

20 Sep, 2012

-

Source:

http://rss.cnn.com/~r/rss/money_news_international/~3/p19PhMHTVJc/index.html--

Manage subscription | Powered by

rssforward.com