The Joy of Tech

FORTUNE -- Apple (AAPL), as usual, chose carefully whom to seed with pre-release review copies of the new iPhone: The biggest newspapers and magazines, the friendliest bloggers and, with pointed exceptions, the most influential tech sites.

Walt Mossberg, The Wall Street Journal: The iPhone Takes to the Big Screen. "The world's most popular smartphone becomes significantly faster, thinner and lighter this week, while gaining a larger, 4-inch screen—all without giving up battery life, comfort in the hand and high-quality construction."

David Pogue, The New York Times: IPhone 5 Scores Well, with a Quibble. "Apple calls its [charging connector] replacement the Lightning connector. It's much sturdier than the old jack, and much smaller — 0.31 inch wide instead of 0.83. And there's no right side up — you can insert it either way. It clicks satisfyingly into place, yet you can remove it easily. It's the very model of a modern major connector. Well, great. But it doesn't fit any existing accessories, docks or chargers. Apple sells an adapter plug for $30 (or $40 with an eight-inch cable "tail"). If you have a few accessories, you could easily pay $150 in adapters for a $200 phone. That's not just a slap in the face to loyal customers — it's a jab in the eye."

Ed Baig, USA Today: Apple iPhone 5 in front of the smartphone pack. "When Apple introduced the iPhone 4S last October, you could sense the initial disappointment. Many people were longing for an iPhone 5. The iPhone 4S that came instead may not have represented a dramatic upgrade, but it was a snappy handset with an excellent camera and a sometimes-obedient virtual digital assistant named Siri. It went on to become the best-selling iPhone to date. Nearly a year later the iPhone 5 is upon us. And what I detect this time is lust."

Peter Nowak, CBCNews: iPhone 5 not terribly innovative, but still a smart package. "Devices running iOS 6 will thus have Apple's new Maps app, which isn't as good as its Google-based predecessor. The new app is functional and includes transit stops, but these are incomplete. While there are plenty of streetcar stops marked in Toronto, for example, some subway stations are inexplicably missing. Real-time traffic data, for Toronto at least, is also almost non-existent. It also doesn't include Google's popular Street View, so you can't swoop down to take a pedestrian-level view of locations... If Apple allows it, Google is likely to release its own map app for iOS 6 and fight it out for supremacy."

Harry McCracken, Time: It's all about refinement. "Apple's mojo remains fully operational. The iPhone 5 features some upgrades which, though not groundbreaking in the least, are welcome, like its slightly-larger screen and zippy 4G LTE broadband. It sports an improved version of what was already the single best camera in phonedom. It makes Siri smarter. In short, it's the most polished version yet of what was already easily the most polished phone on the market."

Rich Jaroslovsky, Bloomberg: IPhone 5 Gets Bigger, Thinner, Faster. "The result is a phone that's compact and feather-weight, yet, thanks to the materials used in its aluminum-and-glass body, conveys a sense of solidity and feels great in the hand. It also comes with newly redesigned headphones called EarPods that are the first ever from Apple that don't either immediately fall out of my ears, hurt or both."

Stuart Miles, Pocket Lint: The best iPhone yet? "It's the same iPhone, but it's completely different. That's the main takeaway point for the iPhone 5's design. It's something you can't really appreciate until you get up close and personal with the new phone, but when you do, wow, you'll really notice that difference."

TechCrunch's MG Siegler: With iPhone 5, Apple Has Chiseled The Smartphone To Near Perfection. "You pick it up and it almost feels fake. That's not to say it feels cheap; because it doesn't — quite the opposite, actually. It just doesn't seem real. Certainly not to someone who has been holding the iPhone 4/4S for the past two years. It feels like someone took one of those devices and hollowed it out."

Jim Dalrymple, The Loop: Review: iPhone 5. "That has been my takeaway from the design of the iPhone 5 — small design changes that make for big user experience improvements. It's important to remember that while the changes on the outside may be small to the naked eye, the changes on the inside are huge. Every major component of the iPhone has been changed in one way or another."

Scott Stein, CNET: Finally, the iPhone we've always wanted. "The good: The iPhone 5 adds everything we wanted in the iPhone 4S: 4G LTE, a longer, larger screen, and a faster A6 processor. Plus, its top-to-bottom redesign is sharp, slim, and feather-light. The bad: Sprint and Verizon models can't use voice and data simultaneously. The smaller connector renders current accessories unusable without an adapter. There's no NFC, and the screen size pales in comparison to jumbo Android models. The bottom line: The iPhone 5 completely rebuilds the iPhone on a framework of new features and design, addressing its major previous shortcomings. It's absolutely the best iPhone to date, and it easily secures its place in the top tier of the smartphone universe."

Luke Peters, T3: iPhone 5 Review: "Because various components have been reduced in size, the headphone socket has been moved to the bottom of the device, which comes with its pros and cons. On the plus side, your phone usually goes in your pocket nose first, which means the headphone cable has a clear run out to your ears. On the downside, the jutting jack interferes with your hand when holding it 'upright'. Not all apps will use the gyroscope to flip the screen 180-degrees, either, so you'll have to get used to that."

Mark Prigg, Mail Online: 'Bright, responsive and it just feels right.' "The iPhone 5 is also able to support superfast 4G networks, but unfortunately we were unable to test this as they have not yet launched in the UK. You'll also need a new, smaller SIM card known as a nanosim to use the phone - but most operators should have these in stock when the handset goes on sale."

Tim Stevens, Engadget: iPhone 5 Review. "Thinner. Lighter. Faster. Simpler. The moment the iPhone 5 was unveiled we knew that it was checking off all the right boxes, folding in all the improvements and refinements people have been demanding over the past year -- yet plenty of folks still went to their respective social networks to type out their bitter disappointment. iPhone upgrade ennui seemed to be sweeping the nation, a sentiment that appeared to quickly dissipate when it came time for people to vote with their wallets."

John Gruber, Daring Fireball: The iPhone 5. "The meta story surrounding the iPhone 5 is the same as that of the iPhone 4S a year ago: a gaping chasm between consumers so excited to buy it that they stay up until (or wake up in) the middle of the night to pre-order it, and on the other side, a collective yawn from the gadget and tech press. That story a year ago was lost amid the tributes to Steve Jobs, who died the day after the 4S was unveiled. If anything, that chasm is growing. The collective yawn from the tech press was louder this year; the enthusiasm from consumers is stronger."

20 Sep, 2012

-

Source:

http://rss.cnn.com/~r/rss/money_news_international/~3/6UPe8HljFUI/--

Manage subscription | Powered by

rssforward.com

FORTUNE -- One of the questions I get asked these days is whether a win by Mitt Romney or by Barack Obama would be better for the stock market. To which the only honest answer is "I have no earthly idea." Any competent and dispassionate market analyst will tell you that the financial and psychological states of the U.S. and world economies are the major factors, and that the President's influence on these matters is far less than most people think it is.

FORTUNE -- One of the questions I get asked these days is whether a win by Mitt Romney or by Barack Obama would be better for the stock market. To which the only honest answer is "I have no earthly idea." Any competent and dispassionate market analyst will tell you that the financial and psychological states of the U.S. and world economies are the major factors, and that the President's influence on these matters is far less than most people think it is. Finding Obama at the top isn't what I expected to see when I asked Wilshire to calculate returns by presidential administrations for me. We started with Ronald Reagan because Wilshire didn't begin tracking daily market returns with its Wilshire 5000 index until 1980. That's why Reagan, who took office in 1981, is the first President on our list. (You can find all the numbers in the table to the left.)

Finding Obama at the top isn't what I expected to see when I asked Wilshire to calculate returns by presidential administrations for me. We started with Ronald Reagan because Wilshire didn't begin tracking daily market returns with its Wilshire 5000 index until 1980. That's why Reagan, who took office in 1981, is the first President on our list. (You can find all the numbers in the table to the left.)

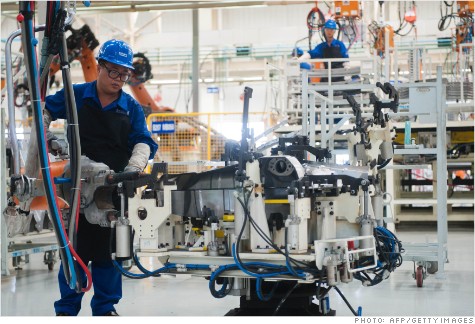

FORTUNE – FedEx, the world's largest air package shipper, sounded the alarms this week on what many corporate executives have feared: China's slowing growth. The world's second-largest economy helped drive global growth when many other economies, including the U.S. and Europe, were still struggling from the global financial crisis.

FORTUNE – FedEx, the world's largest air package shipper, sounded the alarms this week on what many corporate executives have feared: China's slowing growth. The world's second-largest economy helped drive global growth when many other economies, including the U.S. and Europe, were still struggling from the global financial crisis.

FORTUNE -- A slew of luxury goods retailers are leaving Argentina in response to import barriers, currency controls and soaring inflation.

FORTUNE -- A slew of luxury goods retailers are leaving Argentina in response to import barriers, currency controls and soaring inflation.

Global demand for U.S. securities is still strong, with China remaining the largest foreign holder of U.S. debt, according to the Treasury Department's latest report on foreign holdings.

Global demand for U.S. securities is still strong, with China remaining the largest foreign holder of U.S. debt, according to the Treasury Department's latest report on foreign holdings.